Sunday, 30 September 2012

Protest begins against Petronas’ RM60b Pengerang project

The sleepy hollow of Kampung Sungai Rengit came alive this morning with animated chants and blares from portable air horns as green-clad protesters streamed in by the bus loads to rally against a RM60 billion petrochemical project that will see thousands of villagers lose their homes and livelihoods.

The highly-anticipated Himpunan Hijau Pengerang Lestari protest kicked off peacefully to a bright and early start despite earlier fears of possible police blockades to prevent protesters from attending the mass rally.

From 25 different locations across the country, including the east Malaysian state of Sabah, rally participants arrived from 9am onwards, all dressed in Himpunan Hijau’s signature neon green T-shirts and bearing banners that detailed the rally’s three protests — to protest the land grab, to protest the loss of livelihood, and to protest environmental destruction.

As at 10am, the small village square where the township’s landmark steel lobster structure is located was flooded by nearly a thousand protesters.

By noon, event organisers had number the crowd to a generous estimate of 7,000.

The atmosphere was peaceful and almost carnival-like with some rally-goers erecting small booths to sell items like T-shirts, umbrellas, face masks and light snacks, while only a handful of police personnel were seen keeping an eye on the cheerful rally participants.

Seen among the crowd were known Pakatan Rakyat (PR) leaders like PAS vice-president Salahuddin Ayub and Johor DAP chief Dr Boo Cheng Hau, as well as Bersih 2.0 steering committee members Wong Chin Huat and Hishammuddin Rais, who was the emcee for the event.

The vocal activist, Hishammuddin spurred the crowd on by teaching them cheering signals and a song “Suara Rakyat” (voice of the people), which was sung along to the tune of the famous American folk ballad “Oh my darling Clementine”.

Banners and placards condemning Petronas’ Refinery and Petrochemicals Development (RAPID) project, which will see the relocation of over 3,000 people from seven villages girdling the shore of Pengerang, have also been erected across the small Chinese-majority Kampung Sungai Rengit, the only village that has escaped the government’s relocation plans thus far.

According to rally organisers, the government has refused to acquire land from Kampung Sungai Rengit residents due to the high value of the commercial property here.

But a Pengerang PKR leader Taufik Jahir claimed the objective was to “force the villagers from their homes” as Kampung Sungai Rengit will turn into an island once all phases of the Pengerang Integrated Petroleum Complex (PIPC) is completed in the years ahead.

RAPID is set to occupy over 6,424-acres of PIPC’s 22,500 acres, which is home to some 28,000 Pengerang parliamentary constituents in the southernmost tip of Johor. PIPC is a massive RM170 billion project that is expected to turn Malaysia into a mega petrochemical hub.

“Once they have been turned into an island, the Kampung Sungai Rengit property values will drop and the residents will be forced out, having lost their means of living,” Taufik told The Malaysian Insider.

Taking the stage during the rally later, a few local residents sought to condemn the multibillion ringgit petroleum project, telling the crowd that “we are not Taiwan’s dustbin”.

They were referring to KuoKuang Petrochemical’s reported involvement in the project, which villagers have condemned as the firm reportedly had to abandon its plan to house a petrochemical project in Taiwan following concerns that those living in close proximity to such developments would see their lifespans reduced.

“We will stand to protect our land. We will throw them into the dustbin,” said one villager.

NGO Pengerang chief Anis Afida Mohd Azli later described the rally as a historical event for the local folk of Pengerang, whom she said had dared to stand up to express their disdain with the government.

“As I stand here on this stage, I feel so much pride because I have managed to become a part of history, a history charted today that proves Malaysians are rising against cruel leaders.

“Look around you and see how your fellow Malaysians are with you. We are not alone. We need not be afraid to defend our own lands,” she said.

She said since RAPID was given the go-ahead in May last year, local NGOs opposed to the project, and have been “on our knees” before the people, hoping for support to keep the issue alive.

“This October 8, we will go to the mentri besar’s office to voice the people’s wishes. Today, I think, was enough to send a message to the government that Pengerang folk want to be able to enjoy their God-given blessings,” she said.

The protest today ended peacefully shortly after noon. There were no untoward incidents reported. - TMI

BP sells PTA plant in Malaysia for RM713mil

BP Plc will sell its purified terephthalic acid (PTA) production plant in Malaysia to India's Reliance Global Holdings Pte Ltd for US$230mil (RM713mil).

The agreement concerned BP's 100% equity in Kuantan-based BP Chemicals (M) Sdn Bhd (BPCM), British oil and gas giant said.

The transaction would be completed by the year-end, it said in a statement.

“This is an efficient plant with a good market position in the region,” said James Yim, head of BP's aromatics business in Asia.

“Recron Malaysia, part of the Reliance Group, is already our largest customer in Malaysia and Reliance Industries is a significant feedstock supplier at Kuantan, so Reliance is a natural owner of this plant,” he said.

Nick Elmslie, chief executive of BP Petrochemicals said that BP had a major, global PTA business, with around one fifth of global PTA production capacity and a track record of leading technology.

“Hence, BP would continue to concentrate its PTA strategy on deploying new technologies into high-growth markets like China where the company is in the middle of a considerable expansion programme,” he said.

BP's current net global PTA capacity is 7.5 million tonnes per year (mtpa). Its largest plant is in Zhuhai, China where expansion of its current capacity of 1.5 mtpa is expected to add a further 1.25 mtpa by 2014, making it one of the world's largest PTA manufacturing sites.

BP's acetic acid manufacturing and marketing business in Malaysia was unaffected by the sale, said BP. - Bernama

The agreement concerned BP's 100% equity in Kuantan-based BP Chemicals (M) Sdn Bhd (BPCM), British oil and gas giant said.

The transaction would be completed by the year-end, it said in a statement.

“This is an efficient plant with a good market position in the region,” said James Yim, head of BP's aromatics business in Asia.

“Recron Malaysia, part of the Reliance Group, is already our largest customer in Malaysia and Reliance Industries is a significant feedstock supplier at Kuantan, so Reliance is a natural owner of this plant,” he said.

Nick Elmslie, chief executive of BP Petrochemicals said that BP had a major, global PTA business, with around one fifth of global PTA production capacity and a track record of leading technology.

“Hence, BP would continue to concentrate its PTA strategy on deploying new technologies into high-growth markets like China where the company is in the middle of a considerable expansion programme,” he said.

BP's current net global PTA capacity is 7.5 million tonnes per year (mtpa). Its largest plant is in Zhuhai, China where expansion of its current capacity of 1.5 mtpa is expected to add a further 1.25 mtpa by 2014, making it one of the world's largest PTA manufacturing sites.

BP's acetic acid manufacturing and marketing business in Malaysia was unaffected by the sale, said BP. - Bernama

Friday, 28 September 2012

Higher gas and power tariffs?

The Energy, Green Technology and Water Ministry has recommended to the Economic Council that electricity and gas tariffs be raised to better reflect market prices.

The government is expected to decide on electricity and gas tariffs by December.

The last hike in gas and electricity prices was on June 1 last year.

At that time, natural gas price sold to the power sector was raised by 28 per cent to RM13.70/mmBTU from RM10.70/mmBTU.

The average electricity tariff went up 2.23 sen/kWh (kilowatt hour), or seven per cent, to 33.54 sen/kWh.

Electricity rebate for residential households with a monthly bill of up to RM20, however, was maintained.

"Although the tariffs have remained unchanged for more than a year, we have continued to monitor and make the appropriate recommendation on tariff revision for gas and electricity every six months," said Energy, Green Technology and Water Minister Datuk Seri Peter Chin Fah Kui.

"We have forwarded our proposal for revision in electricity and gas tariffs to the Economic Council," he told reporters after officiating the Fourth Energy Forum here yesterday.

"The ultimate decision on whether or not to raise the tariffs lies with the cabinet. My ministry can only act on cabinet's decision," he added.

Six months ago, the Energy Commission announced the groups that had submitted their bids to build a new 1,000MW-1,400MW gas-fired power plant in Prai, Penang.

Among them were 1Malaysia Development Bhd (1MDB), which has teamed up with South Korean Hyundai Engineering & Construction, YTL Power International Bhd with Marubeni Corp of Japan, CI Holdings Bhd and Teknologi Tenaga Perlis Consortium Sdn Bhd with Daelim Industrial Co Ltd of South Korea, Amcorp Power Sdn Bhd with Mitsui & Co Ltd, and Malakoff Corp Bhd and Petronas Power Sdn Bhd with Mitsubishi Corp of Japan.

In response, Chin said the government will announce the winner next month.

"The competitive bidding ensures the use of the latest turbines that optimise gas use. We want value for money," he said.

"We will also announce details on the extension of the first generation power purchase agreements next month," he added.

Kerteh BioPolymer Park To Draw RM7 Billion Foreign Investment By 2015

The 1,000-hectare Kerteh BioPolymer Park (KBP) in Kemaman is expected to attract several global biotechnology players with anticipated foreign direct investment worth around RM7 billion by 2015.

East Coast Economic Region (ECER) Development Council Chief Executive Officer Datuk Jebasingam Issace John cited a RM2 billion project by South Korea's CJ CheilJedang Corporation and France's Arkema to produce the world's first green biotechnology based Lmethionine.

"Physical works for their plant in KBP have already started and operations are expected to come on-stream by 2014," he told reporters.

Earlier, he attended the planting of 40,000 'petai belalang' (Leucaena leucocephala) seedlings, officiated by Menteri Besar Datuk Seri Ahmad Said, at Merchang here today.

Besides CJ and Arkema, US-based biochemical company Gevo Inc, which develops bio-based alternatives to petroleum-based products, will invest RM1.96 billion to develop a bio-isobutanol plant in KBP.

Jebasingam said ECER, the state government and Biotech Corp are also looking to build a biorefinery complex slated to be operational by 2014.

"The project is expected to generate a cumulative GNI (Gross National Income) of RM20.4 billion by 2020 and produce 2,500 green jobs in Malaysia.

"The implementation of these project in KBP will help strengthen Malaysia's position as a choice destination for biotech industry development in this region.

"We will use petai belalang to fuel the biotechnology demand in KBP, the trunks can be used to make wood board while the leaves and fruits can be used as biomass-based feedstock," he said.

-- BERNAMA

Thursday, 27 September 2012

GE To Supply Gas Turbine-Driven Compressor Train Technology To Petronas

GE Oil & Gas will supply its gas turbine-driven compressor train technology to Petronas for a floating liquefied natural gas (FLNG) facility being developed off the coast of Sarawak.

GE said the project is scheduled to begin operating in the fourth quarter of 2015 and will be moored about 180 km off the coast of Bintulu, and is designed to produce 1.2 million tonnes a year (mtpa) of LNG.

"Once on stream, the facility will boost Malaysia's total LNG production capacity to 26.9 mtpa from 25.7 mtpa currently," it said in a statement today.

Its President and Chief Executive Officer (Turbomachinery) Prady Iyyanki said the contract underscores the confidence that Petronas has in GE's compressor technology to support the global LNG industry.

"We look forward to working with Petronas and its project partners to demonstrate how FLNG can help address Malaysia's energy needs," he said.

GE was awarded the contract primarily on the basis of its technology and its experience in the LNG and offshore sectors.

-- BERNAMA

Urusniaga AGEX dijangka cecah RM307 juta

Ekspo Minyak dan Gas ASEAN (AGEX) 2012 dijangka menarik urusniaga bernilai AS$100 juta (RM307 juta) berbanding AS$80 juta (RM245.6 juta) pada tahun lepas.

Pengarah Urusan Fireworks Trade Media, Jerel Soo berkata, ekspo itu merupakan platform terbaik untuk meninjau peluang perniagaan minyak dan gas.

“Selain itu, peserta juga berpeluang mengembangkan perniagaan dan menembusi perniagaan yang baru berkembang di Sabah.

“Kita juga menjangkakan lebih ramai penggiat industri untuk turut serta," katanya pada sidang media ekspo tersebut di sini hari ini.

Turut hadir ialah Menteri Wilayah Persekutuan dan Kesejahteraan Bandar, Datuk Raja Nong Chik Raja Zainal Abidin dan Ketua Pegawai Eksekutif Labuan Shipyard & Engineering Sdn. Bhd., Mohd. Azman Nasir.

Ekspo selama tiga hari yang bermula pada 30 September dan berakhir pada 1 November ini akan berlangsung di Pusat Konvensyen Taman Kewangan Labuan.

Nong Chik berkata, industri gas dan minyak dikenal pasti sebagai tiga faktor utama yang diberi fokus Bidang Keberhasilan Utama Nasional (NKRA) dan peluang ini diambil dalam meningkatkan ekonomi Labuan.

“Labuan yang kaya dengan hasil minyak dan gas harus digunakan dengan sebaik-baiknya dan pengunjung serta peserta perlu memanfaatkan peluang ini untuk bertukar pengetahuan serta menjana pendapatan mereka," katanya. - Utusan

Wednesday, 26 September 2012

OTI among Eight Local O&G Companies Join Matrade's Mission To Kazakhstan

Eight Malaysian oil and gas companies will participate in the Malaysia External Trade Development Corporation's (MATRADE) Specialised Marketing Mission to Kazakhstan

from Sept 30-Oct 5.

The eight companies are Amtech Chemical Sdn Bhd, Innovative Fluid Process Sdn Bhd, Topaz Integrated Technology Sdn Bhd, Transmaris Techno-Sciences Sdn Bhd, Oilfield Technical Inspection Sdn Bhd, Tekno Logam Sdn Bhd, Pioneer Engineering Sdn Bhd and XHP Ventures Sdn Bhd.

"We choose Kazakhstan as the result of our first encounter with the country last year, especially in the oil and gas sector.

"That first meeting generated sales of more than RM30 million and we are going in again to secure more collaborations," MATRADE Deputy Chief Executive Officer, Datuk Zakaria said in a statement here today.

He believed that the few Malaysian companies that are currently operating in Kazakhstan will serve as an impetus for other local businesses to grow further there.

SapuraKencana unit wins Pearl oil contract

SapuraKencana Petroleum Bhd's wholly owned subsidiary TL Offshore Sdn Bhd (TLO) has secured some US$25mil worth of job from Pearl Oil (Amata) Ltd, a Mubadala Petroleum affiliate.

In a filing with Bursa Malaysia, SapuraKencana said the contract was for procurement, construction and installation for a production/processing platform, pipelines and pipeline end manifold for the Manora Field Development, Thailand with Pearl Oil. Pearl Oil is the operator of the Manora oil field in the G1/48 concession with partners Tap Energy (Thailand) and Northern Gulf Petroleum.

The contract comprises of procurement of equipment and bulk materials, fabrication, transportation, installation and hook-up of a wellhead processing platform and two 2km pipelines in the Manora oil field, which lies in 44 m of water about 80km from the coast of Thailand.

Two Firms Expected To Invest US$16 Billion - US$20 Billion In Pengerang

Two foreign companies are expected to invest between US$16 billion and US$20 billion in the Pengerang Integrated Petroleum Complex (PIPC), said Johor Petroleum Development Corp Bhd (JPDC).

Its chief executive officer, Mohd Yazid Jaafar, said the companies, from Taiwan and Singapore, were currently doing soil investigation in the area to see whether the said land (2,000-2,400 hectares) was suitable for their potential investments.

He said the investments from the companies would be in phases, involving the construction of facilities to refine oil, naptha cracker and petrochemical complex.

"Their investments are almost the same like Petronas' Refinery and Petrochemical Integrated Development (RAPID) project.

"If the project is smoothly implemented, PIPC will not only have one RAPID complex but three," he told Bernama here today.

Mohd Yazid, who declined to name the companies, said the preliminary works would take a year.

"We expect the companies to make the 'final investment decision' by next year and construction work to start after that.

"The facilities planned by the companie s are expected to be operational by 2016 to capitalise on the market upswing in 2017-2018.

He said the two companies were expected to bring in their business partners, especially in petrochemical and other downstream sector, to PIPC.

"The Taiwanese firm is expected to bring in between 20 and 24 business partners," he said.

JPDC is a federal government agency which is jointly chaired by Minister in Prime Minister's Department Datuk Seri Idris Jala and Johor Menteri Besar Datuk Abdul Ghani Othman.

It aims to coordinate the development of the oil and gas sector in Johor, especially downstream industries such as processing and storage of oil and petrochemicals.

The PIPC project involves the development of 8,000ha in Pengerang, of which about 2,549.51ha was acquired by Petronas to develop RAPID, which involved an investment of RM60 billion.

-- BERNAMA

Tuesday, 25 September 2012

Total buys 40pc of Mozambique PSC from Petronas Gas

Total, a French oil and gas company, has agreed to buy a 40 per cent stake in a production sharing contract (PSC) in a field offshore Mozambique from Petronas Gas Bhd, a subsidiary of Petroliam Nasional Bhd (Petronas) for an undisclosed sum.

The two companies signed a farm-in agreement yesterday for the acquisition of the 40 per cent interest in the PSC covering the offshore blocks area 3 and 6, located in the prolific Rovuma Basin in Mozambique.

In a statement, Total said Petronas will retain the operatorship for the two blocks, covering an area of 15,250 sq km with water depths ranging up to 2,250m.

"An exploration well is planned by year-end," the company said.

Total senior vice president exploration and production Africa Jacques Marraud des Grottes said after Kenya and Uganda, the company is entering into the southern part of the prolific Rovuma Basin, whose oil potential might equal the gas potential of the northern part.

"The farm-in significantly strengthens our long-term presence in exploration and production in East Africa. Exploration wells are expected to be drilled shortly," he said, adding the transaction is subject to the approval of the Mozambique government.

Total has been present in Mozambique since 1991 through its petroleum product storage and marketing affiliate.

Total Mozambique markets fuels and lubricants to consumers and industry via two import terminals and a network of 35 service stations.

In October 2008, Petronas, together with Empresa Nacional de Hidrocarbonetos de Mozambique (ENH) was awarded the exploration and production concession contract (EPCC) for two exploration blocks, namely Area 3 and Area 6 by the Mozambique government.

Under the terms of the EPCC, PC Mozambique (Rovuma Basin) Ltd,a wholly-owned subsidiary of Petronas holds a 90 per cent interest in both blocks, which are located in the Rovuma Basin, while ENH owns the remaining 10 per cent interest.

Petronas first entered Mozambique's upstream oil and gas industry when it was awarded a contract for offshore Zambezi Delta Block in June 2002.

Matrade's Oil & Gas Exhibition Generates RM730.63 Million In Sales

The Malaysia Oil & Gas Services Exhibition and Conference (MOGSEC) 2012 has generated total sales of RM730.63 million.

The sales encompassed the export of products and services of construction and installation; engineering, procurement and construction; logistics; manufacturing, exploration and production supply; pipe cutting; and engineering, exploration and production.

The inaugural exhibition, held by Malaysia External Trade Development Corp (Matrade) on Sept 18-19, 2012, saw 110 effective business meetings involving foreign companies from the United States, Oman, United Kingdom, South Africa, Yemen and Zambia as buyers with local O&G products and services exporters.

Other products and services including line pipe, tubing valves, chemicals and consultation were also on the agenda of the meetings and are currently in the process of further negotiations.

-- BERNAMA

Monday, 24 September 2012

LNG boost for Petronas from proposed RM10bil processing module

National oil and gas corporation Petronas' proposed RM10bil liquefied natural gas (LNG) processing module, at the Petronas LNG Complex in Bintulu, will produce an additional 3.6 million tonnes of LNG per annum.

Petronas Carigali Sarawak operation head Mohd Nazori Janor said the company was aggressively pursuing the Floating LNG Project, known as Petronas LNG Train 9, offshore Sarawak.

“Petronas will spend about RM300bil over five years (2012-2017) on enhanced oil recovery as well as brown, small and marginal field development in Malaysia to sustain production level and increase resource base and generate jobs and business opportunities in the oil and gas sector,” he said in a statement.

Upon completion, the Train 9 project will include gas receiving facilities, acid gas removal unit, dehydration and mercury removal unit, fractionation and liquefaction unit, LNG rundown unit and all the associated utilities and facilities.

The project is targeted to meet its final investment decision by the first quarter of next year with start-up targeted for the fourth quarter of 2015.

At present, the Petronas LNG Complex, which receives its gas supply from upstream facilities offshore Sarawak, has an existing capacity to produce 24 tonnes of LNG per annum.

Apart from Petronas' presence in Sarawak, including the success in doing business that was built upon its solid reputation, Mohd Nazori said its presence would grow even more rapidly in the coming years with the development of the RM60bil Refinery and Petrochemical Integrated Development project in Johor.“Petronas is also paying high gas subsidies to help fuel industrial growth in Malaysia,” he said, adding that gas subsidy to be borne by Petronas this year was expected to increase to RM28bil from RM23.7bil last year. - Bernama

Friday, 21 September 2012

Johor Sasar Kemampuan Penyimpanan Minyaknya Cecah 10 Juta Meter Padu

Johor menyasarkan kemampuan penyimpanan minyaknya akan mencecah 10 juta meter padu antara 2017-2020 bagi membolehkannya muncul sebagai hab penyimpanan minyak Asia yang baharu, kata Johor Petroleum Development Corporation Berhad (JPDC).

Ketua Eksekutifnya, Mohd Yazid Jaafar berkata kemampuan penyimpanan minyak sebanyak 10 juta meter padu itu akan datang dari kompleks-kompleks yang terdapat di Pengerang, Tanjung Bin dan Tanjung Langsat.

"Kita merancang untuk mencapai matlamat itu (10 juta meter padu) itu secara berfasa antara 2017-2020," katanya kepada Bernama di sini baru-baru ini.

JPDC merupakan sebuah agensi kerajaan pusat, yang baharu sahaja ditubuhkan bagi menyelaras pembangunan sektor minyak dan gas di Johor, terutamanya di dalam industri hiliran seperti penapisan dan penyimpanan minyak serta petrokimia.

Menteri Di Jabatan Perdana Menteri Datuk Seri Idris Jala dan Menteri Besar Johor Datuk Abdul Ghani Othman, merupakan pengerusi bersama JPDC.

Menurut Mohd Yazid, mengikut perancangan Pengerang bakal mempunyai kemampuan penyimpanan minyak sebanyak 5.0 juta meter, manakala Tanjung Bin pula 3.0 juta meter padu dan 2.0 juta meter padu pula di Tanjung Langsat.

Pada masa ini, kemampuan penyimpanan minyak di Tanjung Langsat adalah 650,000 meter padu manakala di Tanjung Bin pula mencecah 840,000 meter padu, katanya.

Di Pengerang, syarikat Dialog dengan kerjasama Royal Vopak NV dan kerajaan negeri sedang membina kemudahan Terminal Petroleum Air Dalam Bebas (IDPT) bernilai RM5 bilion yang dijangka siap sepenuhnya pada 2014.

Fasa pertama projek itu termasuk membina kemudahan penyimpanan minyak bagi 1.3 juta meter padu, bernilai RM1.9 bilion, akan siap pada tahun depan.

Jika dibesarkan lagi, kemudahan itu mampu menampung tambahan lebih 1.0 juta meter padu minyak.

Baru-baru ini, Johor Port memberitahu Bernama bahawa ia sedang dalam peringkat akhir rundingan dengan tiga pelabur tentang pelaburan bernilai RM2 bilion di dalam operasi penyimpanan minyak di Pusat Maritim dan Petrokimia Tanjung Bin (TBPMC).

TBPMC dibangunkan oleh Seaport Worldwide Sdn Bhd, sebuah anak syarikat penuh Johor Port.

Menurut Mohd Yazid, pihaknya juga menyasarkan perolehan simpanan antara 0.8 hingga 1.2 juta meter padu perolehan tangki sebulan sebagaimana tahap industri yang diamalkan di negara jiran, Singapura.

"Ia bermakna di dalam setahun, di antara 100 juta hingga 140 juta meter padu minyak keluar masuk tangki-tangki terbabit," katanya.

Pada ketika ini, kemampuan penyimpanan minyak bebas di Singapura adalah kira-kira 10 juta meter padu, manakala di Amsterdam-RotterdamAmtwerp (ARA) mencecah di antara 40-45 juta meter padu.

-- BERNAMA

Today's jobs update [21-Sept-12]

Australia is booming and we need 63 inspectors today!

Are you available or do you know someone who is?

We will pay you a finders fee of £250 if someone your recommend starts employment with us

PCN/ EN 473 only

UT,MT,PT,RT

For the RT inspectors there is a course and exam to do (similar to RPS), starting on the 8 th October, and will provide all RT people with a WA RT licence. This will be required for the Gorgon project and to work as an RT operator in Perth WA

Our client companies employ more than 30,000 people worldwide.

Many of our current contracts are on the massive Gorgon Project offering very attractive

terms and conditions and a great lifestyle

Gorgon is one of the world's largest natural gas projects and the largest single resource natural gas project in Australia's history.

The Gorgon Project will develop the Gorgon and Jansz/Io gas fields, located within the Greater Gorgon area, about 130 kilometres off the north-west coast of Western Australia.

It includes the construction of a Liquefied Natural Gas (LNG) plant on Barrow Island and a domestic gas plant supplying gas to Western Australia.

PLEASE S Re SUBMIT YOUR CV WITH YOUR PCN NUMBER, IN A WORD DOC

ON THE FRONT OF YOUR E MAIL PLEASE INDICATE WHAT LEVELS YOU HAVE

To cliff@hsee.co.uk

Terminal LNG operasi Oktober

Terminal Regasifikasi Gas Asli Cecair (LNG) di Sungai Udang, Melaka dijangka beroperasi secara komersial menjelang Oktober ini.

Menteri Di Jabatan Perdana Menteri, Datuk Seri Idris Jala berkata, dengan adanya terminal tersebut dan ditambah dengan beberapa projek lain, Malaysia sudah bersedia untuk menjadi hab minyak dan gas di Asia.

" Ini sejajar dengan hasrat kerajaan yang dinyatakan menerusi Program Transformasi Ekonomi (ETP)," katanya semasa sidang akhbar selepas merasmikan Persidangan dan Pameran Perkhidmatan Minyak dan Gas Malaysia (MOGSEC) di sini hari ini.

Kemudahan memproses gas milik Petronas Gas Bhd. itu membabitkan pembinaan kemudahan regasifikasi, unit penyimpanan terapung dan saluran paip dasar laut dengan kapasiti penghantaran maksimum gas sebanyak 3.8 juta tan setahun.

Regasifikasi adalah proses penyejatan untuk menukar LNG kembali ke dalam bentuk gas yang membolehkan ia diangkut ke terminal pengedaran.

Dalam pada itu, Idris yang juga Ketua Pegawai Eksekutif Unit Pengurusan Prestasi dan Pelaksanaan (Pemandu) berkata, MOGSEC dijangka mampu menarik kira-kira 10,000 pembeli perdagangan dari industri tersebut.

Tambahnya, industri minyak dan gas merupakan pemangkin kepada ekonomi negara dan menjadi penyumbang utama kepada pendapatan Malaysia.

Seramai 289 peserta pameran yang terdiri daripada penyedia perkhidmatan dan produk berkaitan minyak dan gas menghadiri MOGSEC yang berlangsung selama tiga hari.

Antara pemain industri yang terlibat adalah Petronas, MMC Oil & Gas, Muhibbah Engineering, SapuraKencana Petroleum, Schlumberger WTA, Technip, UMW Oil & Gas serta Wasco.

Thursday, 20 September 2012

Pertamina negotiating gas price on Malaysian block

Indonesia’s state run oil and gas company Pertamina is in talks to raise the price it receives for natural gas from a block in Malaysia.

The Jakarta Post reported that Pertamina had entered talks with Malaysia’s Petronas and PetroVietnam Exploration & Production (PVEP) after it realised the SK 305 Block contained natural gas that it believed it could not sell for a good price.

The newspaper quoted the president director of Pertamina subsidiary Pertamina Hulu Energi, Salis S Aprilian as saying that Pertamina and PVEP agreed to negotiate a gas price that was more economic and competitive.

According to Salis, Pertamina sells its natural gas to Petronas for $1 per million British thermal units, while he stated the average sale price in Malaysia was between $5 and $6 per mmBtu.

“We expect to raise it to around $3.80 to $5 per mmBtu. I guess we would not raise it over $6,” the Jakarta Post quoted Salis as saying.

Negotiations are expected to be completed later this month.

Output at Block SK 305 currently averages about 22 million standard cubic feet of gas per day and 2000 barrels of oil per day.

Pertamina holds a 30% share in the block, while Petronas owns 40% and PVEP holds the remaining 30% share.

Lundin takes aim west of Janglau oil find

Sweden’s Lundin Petroleum has spudded an exploration probe aiming to tap potential west of its Janglau oil find off the east coast of peninsular Malaysia.

Seadrill's West Courageous rig is to drill the Merawan Batu 1 well at block PM308B to a depth of 3584 metres in around 60 metres water depth.

The well will target hydrocarbons in Oligocene aged sands in a faulted anticline in an undrilled area 50 kilometres west of 2011’s Janglau discovery by the Swedish independent in PM308A.

Lundin Petroleum holds a 75% stake in the Penyu basin block with Petronas on 25%.

The same rig discovered gas last week elsewhere offshore Malaysia with the Berangan 1 well, the third find within two years at the SB303 block.

Wednesday, 19 September 2012

Shell's Arctic offshore drilling suffers setback

ANCHORAGE, Alaska (AP) — Shell Oil Co. is limiting Arctic offshore drilling off Alaska in 2012 to preparation work after suffering several setbacks, but company President Marvin Odum said Monday that remains a significant accomplishment.

Royal Dutch Shell PLC announced earlier in the day that a containment dome required to be in place before drills can enter oil-bearing rock in the Chukchi and Beaufort seas was damaged Saturday during testing off Bellingham, Wash.

Environmental groups quickly blasted the company, saying the latest setback and others are evidence the oil industry cannot safely drill in the Arctic.

Odum told The Associated Press that although the company no longer plans to try to drill deep enough to reach oil this year, the company has made great strides with its exploratory wells off the Alaska coast.

"That drilling is going to be limited to top holes, but that is a tremendous step forward in terms of this multiyear exploration program in the Alaska Arctic," he said.

The dome and Shell's oil spill containment barge, the Arctic Challenger, are required to be positioned near the company's drill ships before they drill into hydrocarbon zones.

Shell already faced a rapidly closing window for drilling during the open-water season — when the seas are mostly free of ice — and the damaged dome was the clinching impediment.

Odum would not speculate on the cause or extent of damage.

"There is an investigation going on right now to actually put the details behind it," Odum said. "I'm going to wait for that report, which shouldn't take very long."

Shell hopes to tap into federal estimates of 26 billion barrels of recoverable oil and 130 trillion cubic feet of natural gas in U.S. Arctic waters. Odum remains optimistic.

"We're exploring offshore Alaska for the first time in several decades, and we have two drilling ships out there and over 20 support vessels, some of which were purpose-built for the area," he said. "We're drilling in the Chukchi, and I expect we'll be drilling in the Beaufort soon."

Environmental groups strongly oppose Arctic offshore drilling, claiming oil companies have not demonstrated the ability to clean up spilled crude in ice, and that operating in one of the world's most hostile marine environments is a risk to its polar bears, walrus and endangered whales. They pounced on the latest Shell setback.

"This series of blunders inspires anything but confidence in the oil industry's ability to safely drill in the Arctic," said Susan Murray, Oceana's Pacific senior director.

A Shell drilling ship in July dragged its anchor and nearly ran aground at Dutch Harbor. Less than a day after a Shell drill ship began drilling a pilot hole Sept. 9 in the Chukchi, a 30-by-12-mile ice sheet heading toward the vessel forced it to move 30 miles south.

"These last few weeks confirm that drilling can't be done safely for one month, much less long-term," said Rebecca Noblin of the Center for Biological Diversity.

Odum said he understands the critics but that the containment system, which didn't exist before Shell put it together for the Arctic, is one aspect to be solved in a multiyear exploration plan.

"If you look at the entirety of this program, you see the strength and the capacity with which Shell has moved back into the Arctic," he said.

Shell will continue working on the containment barge and plans to have it operating in the Arctic this year, he said.

Malaysia set to be regional LNG hub

Malaysia is poised to be the region’s hub for liquefied natural gas (LNG) importation, trading and storage once its LNG regassification terminal in Malacca is ready.

“With the LNG terminal, which will hopefully come on stream in October, we believe that we are poised to be the regional hub for LNG importation, trading and storage,” Minister in the Prime Minister’s Department and Performance Management and Delivery Unit chief executive officer Datuk Seri Idris Jala said.

“A lot of work is also being done in the east (of the country), and I have no doubt in my mind that the plant that the Sipitang Oil and Gas Industrial Park (Sogip) is building in Sabah will also add to the whole array of things happening in the industry,” he said at the inaugural Malaysia Oil and Gas Services Exhibition and Conference 2012 (MOGSEC).

He said the good response to MOGSEC 2012 was a testimony to the country’s vibrant oil and gas sector, which contributed significantly to gross domestic product (GDP).

Earlier in his speech, Idris said the oil and gas industry needed to sustain and maintain production, grow and diversify to continue to power the economy.

He said projects such as the enhanced oil recovery partnership between Petroliam Nasional Bhd (Petronas) and Shell Malaysia, the LNG terminal in Malacca and the RM60bil Refinery and Petrochemical Integrated Development complex in Pengerang were catalytic for further growth.

Idris urged local oil and gas companies to adopt best practices to enable them to compete internationally.

“Local companies shouldn’t just focus on growing their businesses here, they should take this platform to grow their business overseas,” he said.

MOGSEC 2012 is expected to attract 10,000 trade buyers and decision makers. The three-day event, which ends on Thursday, is organised by the Malaysian Oil and Gas Services Council.

Tuesday, 18 September 2012

Petronas rancang bina unit pemprosesan gas asli di Bintulu

Petronas Carigali Sarawak merancang untuk melabur sebanyak RM10 bilion untuk membina satu unit pemprosesan gas asli dikenali 'Train 9 Project' di Kompleks Petronas Gas Asli Bintulu.

Ketua Operasi Petronas Carigali Sarawak, Mohd. Nazori Janor berkata, projek berkenaan dijangka mampu menghasilkan sebanyak 3.6 juta metrik tan gas asli setahun.

Menurutnya, Petronas juga merancang untuk membangunkan Projek Gas Asli Terapung yang juga dikenali sebagai 'FLNG1' di luar pesisir pantai negeri ini.

"Petronas juga dijangka akan membelanjakan kira-kira RM300 bilion dalam tempoh lima tahun bermula tahun ini hingga 2015 bagi pemulihan simpanan minyak secara berperingkat.

"Ia juga bagi mengekalkan tahap pengeluaran dan meningkatkan sumber minyak mentah serta menjana peluang pekerjaan dalam sektor minyak dan gas," katanya ketika berucap di Malam Media Petronas - Persatuan Wartawan Utara Sarawak (NSJA) 2012 di sini, hari ini.

Sementara itu, Nazori memberitahu, Petronas telah mengeluarkan kira-kira 40 peratus kepada tabung kebangsaan dan sumbangan termasuk cukai serta pembayaran dividen secara tetap yang mencecah hampir RM30 bilion setahun.

"Subsidi gas yang ditanggung oleh Petronas dijangka meningkat pada tahun ini iaitu RM28 bilion berbanding RM23.7 bilion tahun lalu," katanya.

LNG TerminalWill Complement Dialog Group's Business, Boost Recurring Income

The liquefied natural gas (LNG) terminal project in Pengerang, Johor, is expected to complement Dialog Group Bhd's business soon and boost recurring income once the terminal is operational.

In a note today, OSK Research said the project, if successfully implemented, would complement Dialog's business by generating jobs for its service provider division.

Dialog is part of the consortium with Royal Vopak NV and the Johor state government, that plans to invest some RM4.08 billion in the development of the terminal.

"We believe the new investment is positive for the company in the long run in view of the stronger demand for LNG in this region following the Fukushima incident in 2011," he said.

The research house has maintained its 'buy' call on the company with unchanged fair value at RM3.16.

Meanwhile, AmResearch in its note, also maintained its 'buy' call on the company with an unchanged fair value at RM2.85.

It also maintained the financial year 2012-2014 forecasts for net profits with the expectation of further positive newsflow for the group.

-- BERNAMA

Friday, 14 September 2012

Malaysia starts pumping oil at Gumusut field - sources

- Gumusut crude output to reach 25,000 bpd by end 2012

- To blend Gumusut crude with Kikeh for sale until export terminal ready

- Gumusut output to hit full 135,000 bpd in 2013-2014 on construction delay

By Florence Tan

SINGAPORE, Sept 12 (Reuters) - Malaysia has started pumping oil from the Gumusut deepwater oilfield offshore Sabah, with an initial output of 10,000 barrels per day (bpd), sources familiar with the matter said on Wednesday.

Gumusut, operated by Royal Dutch Shell and discovered in March 2004, is expected help Malaysia reverse its declining output and boost the country's oil revenue, but its start up has been dogged by construction delays.

Crude output at Gumusut, located off the eastern state of Sabah in Block J, is expected to reach 25,000 bpd by the end of this year, said the sources, who declined to be identified due to company policy on speaking to the media.

Gumusut will be blended with Kikeh for sale in Asia as its output is currently tied to Kikeh's production platform in neighbouring Block K, they said.

This could change Kikeh's crude quality, one source said. Murphy Oil operates the 120,000 bpd Kikeh field.

Gumusut production will reach the full 135,000 bpd in 2013-2014, put back from 2011, as construction of the floating production facility for the field has taken longer than expected.

Crude exports directly from the Gumusut field will also depend on when the new terminal at Kimanis, Sabah, is completed, the sources said.

Shell and ConocoPhillips each has a 33 percent stake in the project. Petronas holds 20 percent and Murphy Oil 14 percent. Shell and Petronas did not reply to e-mails seeking comment.

Malaysia's crude output slipped in 2011 to below 600,000 bpd for the first time in at least 10 years, data from the BP Statistical Review of World Energy showed. To arrest the decline, Malaysia is embarking on projects that will coax more oil out of matured fields.

Shell signed an agreement with Petronas in November that could add 90,000 to 100,000 bpd of oil production and extend the life of the Baram Delta and North Sabah fields to beyond 2040.

Exxon Mobil is working with Petronas to improve oil recovery at Malaysia's flagship Tapis field, where output has fallen by more than half from its peak in the 1990s, in addition to new exploration and development projects.

Petronas Carigali Ties Up With MIT Innovation To Develop Cost-Saver Drilling Tool

Petronas Carigali Sdn Bhd, a subsidary of Petronas, has signed a technology collaboration agreement with MIT Innovation Sdn Bhd for the development of a cost-saver drilling tool.

Datuk Mohd Annuar Taib, Petronas Carigali president and Petronas development and production chief executive officer, said the new invention, known as intelligent circulation while drilling (ICWD) tool, would significantly reduce drilling cost in the challenging upstream exploration and development environments.

"Usage of the tool is expected to save more than RM150 million in drilling cost per year in Malaysia as the upstream operations move into new and increasingly harsh and challenging drilling territories," he said in a statement today.

He said the tool is being designed to safeguard complex equipment commonly used in today's drilling operations.

It will help drillers cure losses encountered in difficult wells and allow for continuous drilling operations without the limitations of the current technologies, he added.

-- BERNAMA

Thursday, 13 September 2012

Lundin scores hat-trick with Sabah gas find

Sweden’s Lundin Petroleum has made a third gas find at its block off Sabah, Malaysia, with the Berangan-1 well.

Drilled to a depth of 1709 metres in around 70 metres water depth by the West Courageous rig, the well penetrated a gross gas column of more than 165 metres in the target mid-Miocene aged sands.

The find was made 10 kilometres southeast of the Tarap discovery and 15 kilometres south of the Cempulut discovery, all in the SB303 block where Lundin holds a 75% stake with partner Petronas on 25%.

Chief executive Ashley Heppenstall said Lundin's trio of finds at SB303 - together with the Titik Terang find previously uncovered by Shell at the block but never developed - represented “a clear opportunity to evaluate the potential for a gas cluster development”.

The Swedish independent said that further tests would determine resource estimates, but that data acquired already pointed to a single continuous gas column at Berangan-1.

The rig will next move to offshore Peninsula Malaysia for a three-well campaign, starting with Merawan Batu-1 in the PM308B block.

Earlier this summer, the explorer tasted dust with another probe off Malaysia, Tiga Papan 5, at blocks SB307 and SB308.

Lundin Petroleum is a Swedish independent with assets primarily located in Europe and South East Asia, including six blocks off Malaysia. The company is listed on the NASDAQ OMX and in Stockholm and Toronto.

Today's jobs update[13-Sept-12]

Vacancies Needed to be filled on Immediate Basis ( Contract )

Mechanical Piping Engineer

- Min 5 years in design of pressure vessel for oil and gas industry in accordance with ASME Boiler & Pressure Vessel Code, Section VIII, Division 1&2, preferably including fitness-for-service calculation.

Construction Supervisor.

- Certificate or Diploma in Engineering

- 8 Years experience in the fabrication of oil & gas facilities, modules, chemical plants construction.

Cost Engineer ( controller/ project accountant )

- Degree in any discipline

- 5 years experience in accounting with at least 2 years in oil and gas project accounting and project control

Project Control Engineer

- Degree in engineering

- Relevant experience or 10 + years experience in the oil and gas industry

- Min 5 years in project control ( cost control and some schedule control achievement )

- Upstream/pipeline/ offshore engineering, procurement, and construction experience.

- Proficient in microsoft office suite of software programmes, lotus notes etc.

- Read, write, speak, and present in fluent English, specifically associated with technical and business communication.

Safety Engineer ( project safety advisor )

- Degree

- Demonstrated work experience in construction safety-related positions

- Thorough knowledge of safety standards, codes, and practice

- Safety related experience with facilities fabrication, construction, transportation, and pre – commissioning as appropriate for specific projects.

- Preferred working knowledge of safety management practices, processes and expectation

- Proficient in use of computers and programs such as Microsoft office and lotus notes

- Read, write, and speak fluent English

Offshore Installation Engineer

- Min 4 years working exp in oil & gas

- 2 years working exp onboard construction barges

- Knowledgeable pipe laying subsea cable installation, jacket and topside installation.

- Knowledge in riser clamp & riser guard fabrication, general ROV & diving operation

- Prior working experience as ExxonMobil offshore installation engineer is an added advantage.

Please sent your resume to arif@cekaptechnical.com or waida@cekaptechnical.com and state your prefer position in the subject. For enquiries, you can sent email to that above email as well.

Australian Roc Oil rolling on Balai Cluster appraisal effort

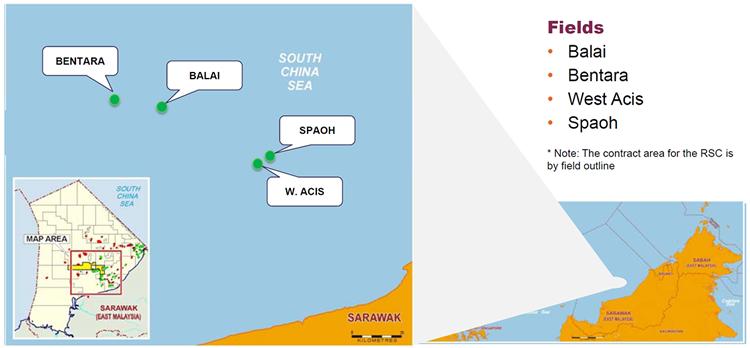

Australian independent Roc Oil has kicked off drilling of the first probe in a multi-well appraisal programme on the Balai Cluster off Malaysia as the partners prepare the way for the four-field development.

The Bentara 2 well, with a target depth of 2750 metres, was spudded on Tuesday as part of the pre-development phase launched by operating consortium BC Petroleum earlier this year for the Balai, Bentara, West Acis and Spaoh fields that make up the cluster off Sarawak.

Drilling work is being carried out from the first of four tarpons to be installed under the preliminary phase, which is expected to be completed early next year.

A decision whether to move forward on full field development is likely to be made next year, conditional on successful completion of appraisal work and the economic viability of the project, after which a development plan would be submitted.

Partners in BC Petroleum, which operates the Balai Cluster risk service contract, are Roc with 48%, Dialog Group on 32% and Petronas Carigali with 20%.

Wednesday, 12 September 2012

SapuraAcergy wins Gulf of Mexico gig

A joint venture between Malaysia’s SapuraKencana and subsea engineering company Subsea 7 has been awarded a $45 million contract for the charter of the Sapura 3000 deep-water heavy lift and pipelay vessel.

The charter, which commenced on 18 August, was awarded to SapuraAcergy by Construcciones Maritimas Mexicanas and will run for a duration of 125 days.

SapuraKencana said on Tuesday the contract would see the Sapura 3000 carry out heavy lifts in the Gulf of Mexico region.

It added that it expected the award to contribute positively towards its earnings for the financial year ending 31 January 2013.

Petronas Gas, Sabah Energy Corp Ink Shareholders Agreement On Regas Terminal

Petronas Gas Bhd has entered into a shareholders agreement with Sabah Energy Corporation Sdn Bhd, which will see the latter subscribing to one ordinary share of RM1,000 each in Regas Terminal (Lahad Datu) Sdn Bhd (RGT).

In a filing to Bursa Malaysia, Petronas Gas said the agreement further provides option for Sabah Energy Corp to subscribe for up to 20 per cent equity in RGT within a stipulated time period.

The option for the subscription is up to 12 months of the commercial operation date of the facilities, failing which, the subscribed share by Sabah Energy Corp up to the said date as well as the right to subscribe to the 20 per cent equity will revert back to Petronas Gas.

RGT, a wholly-owned subsidiary of Petronas Gas, is currently a dormant company that was incorporated to undertake the construction and development of the liquefied natural gas regasification facilities in Lahad Datu, Sabah.

The facilities are expected to be completed in 2015 and will have a send out capacity of 0.76 million tonnes per annum.

-- BERNAMA

Tuesday, 11 September 2012

Today's jobs update [11-Sept-12]

Dear All,

Velosi ‘s finding the candidate of inspector in many positions as below list to work with Carigali Hess who is carrying out several new development for both Greenfield and Brownfied projects

- The current location is at CUEL Limited Construction Yard Laem Chabang Port but it may be located at other yards in Thailand

- It partly begin in end 2012 with staggered completion until 2016.

- 4 years contract, Full time at onshore yard.

Positions:

- Senior General Inspector

- Senior Mechanical Inspector

- Mechanical Inspector

- Senior Piping Inspector

- Piping Inspector

- Senior structural Inspector

- Structural Inspector

- Senior Electrical Inspector

- Senior Instrument Inspector

- Instrument Inspector

- Senior Pipeline Inspector

- Pipeline Inspector

- NDE Inspector

- Painting/Coating Inspector

- Scaffolding Inspector

If you or other are interesting to joint with us, please send your updated CV and qualification certificates for our consideration as my e-mail below.

Best Regards,

Miss Siwaporn Sadtakum

Inspection Project Coordinator

Description: Description: Description: Description: applusvelosi_peq

Velosi Certification Services Co., Ltd.

M | +6685 3177519

E | s-sadtakum@velosi.com Skype| siwa_ie10

T | +6638 351660, +6638 354430-31

F | +6638 351661 W | www.velosi.com

A | 217/27 Moo 12, Tungsukla, Sriracha, Chonburi, Thailand 20230

Cari kaedah baru bekal gas

Gas Malaysia Bhd. (Gas Malaysia) sentiasa mencari jalan untuk terus inovatif bagi membekalkan gas memandangkan banyak kawasan perindustrian masih belum dapat ditembusi.

Pengarah Urusannya, Datuk Muhamad Noor Hamid berkata, faktor utama bekalan gas tidak dapat disalurkan ke sesetengah kawasan industri ialah masalah saluran paip gas dan antara kawasan yang yang masih belum dapat ditembusi ialah Ipoh, Pekan dan Batu Pahat.

''Oleh itu, selain menggunakan saluran paip gas, kami turut menyediakan 'tanker' bagi menghantar bekalan kepada pelanggan.

''Objektif Gas Malaysia adalah menghantar bekalan kepada industri dan bukan sahaja memikirkan peningkatan jualan atau keuntungan.

''Kami masih lagi menilai cara terbaik untuk menghantar bekalan tersebut dan berharap dapat memuktamadkan perancangan itu menjelang akhir tahun ini,'' katanya kepada Utusan Malaysia baru-baru ini.

Ketika ditanya mengenai perancangan Gas Malaysia untuk mengadakan kerjasama dengan syarikat luar, Muhamad Noor berkata, pihaknya tidak menolak kemungkinan untuk menjalankan kerjasama di peringkat antarabangsa pada masa hadapan.

''Pada masa ini fokus kami adalah di pasaran tempatan dan apabila sampai masa, pengembangan perniagaan di luar akan dibuat.

''Kami mempunyai kepakaran dan pengalaman sekiranya tidak menjalankan kerjasama, Gas Malaysia turut mampu mengeksport kepakaran.

''Setakat ini, kami masih lagi meninjau peluang bersesuaian dengan syarikat,'' jelasnya.

Tambah Muhamad Noor, bagi suku ketiga Gas Malaysia optimis mencatatkan keputusan kewangan lebih baik berbanding suku pertama dan kedua tahun ini.

''Keyakinan tersebut dibuat berdasarkan permintaan yang lebih baik dan suku tersebut juga adalah tempoh perbandingan antara suku lebih setanding dengan tahun lalu,'' ujarnya.

Muhamad Noor berkata, pada tahun ini Gas Malaysia telah memperuntukkan perbelanjaan modal tertinggi sebanyak RM140 juta, pada tahun hadapan jumlah tersebut dikurangkan dengan pembayaran dividen juga adalah pada kadar minimum sebanyak 75 peratus.

Gas Malaysia baru-baru ini telah memeterai perjanjian dengan Petronas Gas Bhd. (PetGas) untuk meningkatkan bekalan gas asli sebanyak 110 juta kaki padu standard sehari (mmscfd) kepada 492 mmscfd.

Bekalan tersebut adalah sehingga 2015.

Selepas 2015, Gas Malaysia fokus untuk mendapatkan lebih volum dan optimistik mendapatkannya untuk tempoh 2016 sehingga 2018. - Utusan

Monday, 10 September 2012

McDermott Orders Pipelay Vessel from Spanish Shipyard

McDermott International, Inc. announced that it will build another high capacity reeled pipelay vessel with top-tier payload capacity, tentatively named Lay Vessel 108 (“LV108”).

The vessel will be a sister ship to the recently completed subsea construction vessel the Lay Vessel North Ocean 105 (“LV105”), and is to be built to similar specifications at Metalships and Docks S.A.U. shipyard in Vigo, Spain.

“LV108 is another milestone in our vessel renewal program focusing on the subsea construction market for flexible and rigid product installation,” said Stephen M. Johnson, Chairman, President and Chief Executive Officer of McDermott. “Market analysis indicates that the subsea and deepwater construction market is expected to continue to grow and there is demand for more tonnage in both the rigid reel lay and flexible lay markets. The LV108 is expected to meet this need.”

LV108 is designed for advanced deepwater operations with a high-capacity tower for rigid and flexible pipelay and state-of-the-art marine construction equipment that will enable installation of a variety of products to a depth of 10,000 feet, including rigid-reeled pipelines, subsea components and hardware, and deepwater moorings for floating facilities as well as flexible products – cables and umbilicals.

The principal characteristics of the vessel, such as payload, tension capacity and product size, will mirror those of the LV105, but McDermott anticipates enhanced functionality of the LV108 equipment design compared to the LV105. Delivery of LV108 is anticipated to be around third quarter 2014 for outfitting of the custom-designed lay system, built by a specialist fabricator in Europe.

The vertical reel will have a nominal payload of 2,500 tons plus, subject to vessel loading conditions, and a lay tower operational between 90 and 40 degrees. The nominal tension capacity is expected to be 400 tons, and the range of pipe the vessel can install is between 4 to 16 inches diameter. This 427-foot, dynamically positioned vessel will be equipped with a 400-ton heave compensated crane, will have a transit speed of 15 knots and will operate across a range of water depths up to more than 10,000 feet.

“In May we completed building and outfitting the LV105, a vessel that aims to improve our worldwide capabilities to meet the growing needs and technical challenges of the subsea and deepwater markets. The vessel will perform its first project in Asia in up to 4,430 feet of water. We look forward to LV108 joining the LV105 and other vessels in our fleet in 2014,” said Johnson.

Subscribe to:

Posts (Atom)